SaaS content strategist reveals how obsessing over high LTV:CAC ratios sabotages growth based on real founder case studies and insights.

SaaS content strategist reveals how obsessing over high LTV:CAC ratios sabotages growth based on real founder case studies and insights.

Press enter or click to view image in full size

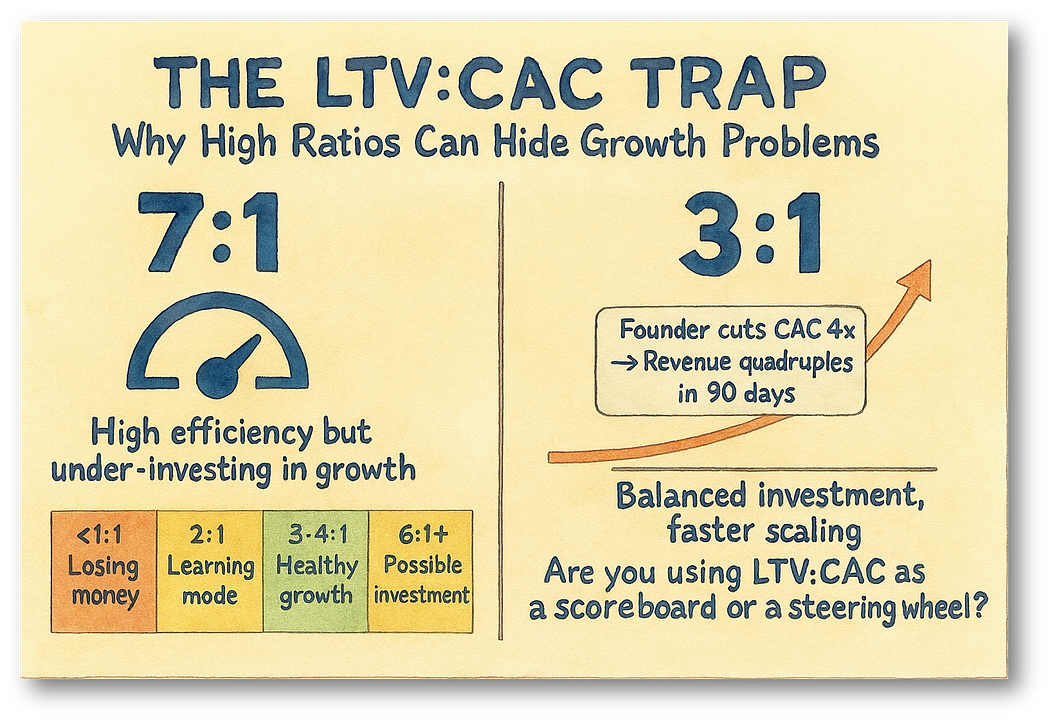

A SaaS founder I worked with hit a “perfect” 7:1 LTV:CAC ratio.

He celebrated it like a milestone.

The problem? His competitor was scaling 4x faster… with a “messy” 3:1 ratio.

That’s when I realized: the obsession with perfect ratios can kill growth.

Over the past few years working with SaaS companies, I’ve seen this pattern repeatedly. Brilliant entrepreneurs sabotage their own growth by chasing metrics that look impressive on paper but strangle real opportunity.

The Seductive Trap of High LTV:CAC Numbers

After working with SaaS companies, I’ve identified a recurring behavioral pattern that derails growth strategies. Founders treat LTV:CAC like a video game high score, constantly pushing for higher ratios without considering the strategic implications.

Here’s how this plays out across the companies I work with:

- Teams celebrate every CAC reduction like a major victory

- Higher ratios become status symbols in founder groups

- Conservative spending becomes the default operational mode

- Growth initiatives get deprioritized in favor of efficiency metrics

The wake-up calls always come from external sources — investor meetings, competitor analysis, or market share reports that reveal the true cost of metric obsession.

Stage-Specific LTV:CAC Strategy: What I Tell My Clients

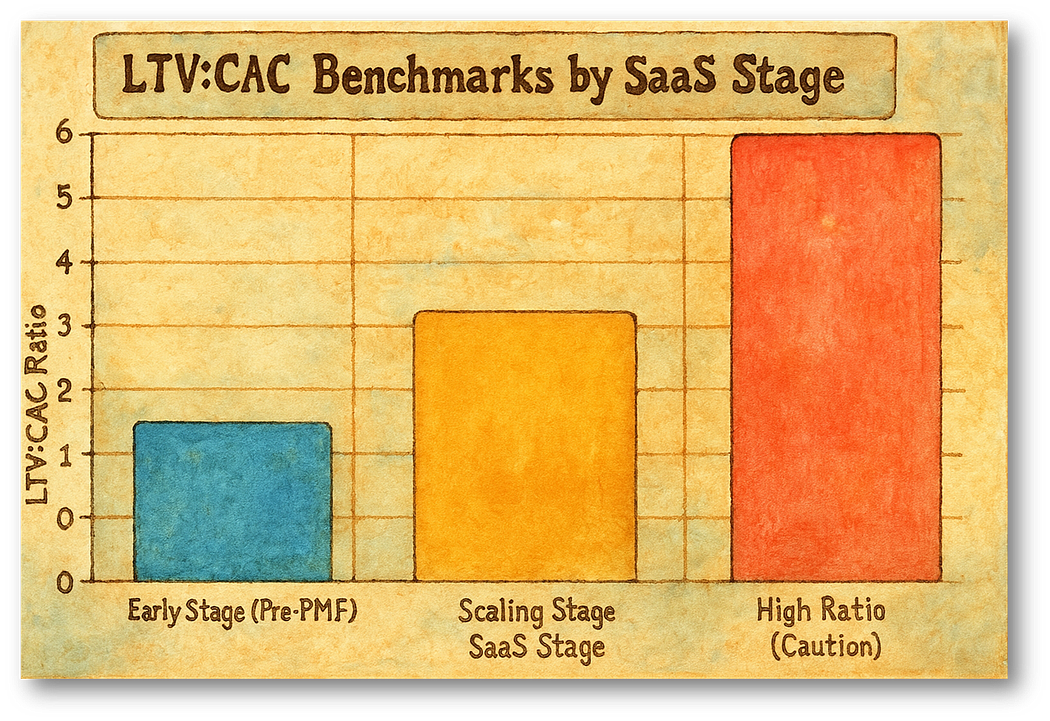

Through analyzing performance across various SaaS companies at different stages, I’ve developed a framework that balances growth ambition with financial discipline.

Press enter or click to view image in full size

Early-Stage Validation (Pre-PMF) During the validation phase, I recommend my clients target 2:1 ratios. This conservative approach preserves runway while teams experiment with messaging, channels, and product-market fit. Higher ratios at this stage often indicate insufficient market testing rather than efficiency.

Growth Stage Acceleration (Post-PMF) Once product-market fit is established, 3:1 to 4:1 becomes the optimal range for most SaaS companies. This balance enables aggressive scaling while maintaining sustainable unit economics. Companies operating above 5:1 during this phase are typically leaving growth opportunities on the table.

Market Leadership Phase Even mature SaaS companies rarely benefit from ratios exceeding 6:1. Higher numbers usually signal either market saturation or missed opportunities for competitive defense through strategic customer acquisition.

The Blended CAC Revolution: A Client Success Story

One of my most dramatic client transformations involved completely reimagining their approach to customer acquisition costs. This particular SaaS founder was burning significant budget on LinkedIn ads with diminishing returns.

After conducting a comprehensive customer journey analysis, we discovered something fascinating: 70% of their conversions originated from referrals, but these referrals were initially triggered by ad exposure. The paid campaigns weren’t directly converting — they were creating awareness that drove word-of-mouth marketing.

Our strategic pivot involved reducing ad spend by 70% and reinvesting those dollars into a sophisticated referral program with automated workflows and incentive structures. The results exceeded all expectations:

- Blended CAC decreased by 75%

- Monthly recurring revenue jumped from $12,000 to $48,000 in 90 days

- Customer quality improved significantly due to referral-based acquisition

This wasn’t just tactical optimization — it was strategic resource reallocation based on understanding the complete customer acquisition ecosystem.

Market Context: Why Universal Benchmarks Fail

Working across different SaaS verticals has taught me that LTV:CAC ratios must be evaluated within competitive and market contexts, not as absolute benchmarks.

Consider these variables that dramatically impact optimal ratios:

Market Maturity Level Early-stage markets reward aggressive expansion over efficiency. Companies that prioritize perfect ratios in nascent markets often lose first-mover advantages to more aggressive competitors.

Competitive Landscape Intensity In highly competitive spaces, the cost of customer acquisition increases over time. Companies that maintain ultra-high ratios may find themselves priced out of effective channels as competitors bid up acquisition costs.

Capital Market Conditions Access to funding enables higher CAC tolerance for growth. During capital-abundant periods, optimizing for efficiency over growth can signal lack of ambition to investors.

Network Effect Potential Winner-take-all markets justify accepting higher short-term acquisition costs to achieve the scale necessary for sustainable competitive advantages.

Strategic Framework for SaaS Growth Optimization

Based on patterns I’ve observed across my client portfolio, here’s the framework I recommend for approaching LTV:CAC optimization:

Dynamic Target Setting Rather than fixed ratio targets, establish ranges that adjust based on business stage, competitive dynamics, and market opportunities. This flexibility enables strategic decision-making rather than metric optimization.

Holistic Channel Analysis Evaluate customer acquisition across your entire marketing mix rather than optimizing individual channels in isolation. Some channels may appear expensive individually while creating synergistic effects that improve overall efficiency.

Competitive Intelligence Integration Regularly analyze competitor growth rates, market share changes, and strategic positioning. Perfect efficiency becomes meaningless if you’re losing competitive ground to more aggressive players.

Scenario-Based Planning Model different CAC scenarios against growth outcomes and long-term business valuation. Sometimes accepting higher acquisition costs accelerates revenue growth that creates superior overall returns.

The Psychology of Metric Obsession

After working with numerous SaaS founders, I’ve noticed something interesting:

LTV:CAC obsession often stems from a need for control.

High ratios provide validation. They feel like winning.

But here’s the trap: the best founders don’t worship the ratio.

They treat LTV:CAC as a diagnostic tool → not a success trophy.

The challenge lies in shifting from metric achievement to strategic outcome focus. Companies that achieve sustainable growth use numbers to guide decisions, not define success.

Building Sustainable Growth Systems

Through my content strategy work, I’ve observed that companies with sustainable growth focus on building systems that can adapt to changing market conditions rather than optimizing for static metrics.

These systems typically include:

- Multi-channel acquisition strategies with built-in redundancy

- Customer lifetime value optimization through retention and expansion

- Competitive intelligence workflows that inform strategic decisions

- Financial modeling that balances growth and profitability scenarios

Advanced Strategies for LTV:CAC Optimization

For SaaS companies ready to move beyond basic ratio management, consider these sophisticated approaches I’ve implemented with clients:

Cohort-Based Analysis Track LTV:CAC performance across different customer segments, acquisition channels, and time periods. This granular analysis reveals optimization opportunities that aggregate metrics obscure.

Future Impact Modeling I often help clients dig through their past performance data to spot patterns. What happens when you double CAC spend? How does it affect revenue six months later? One client discovered that their best customers actually came from their most expensive acquisition months. The data told a story their spreadsheets missed.

Staying Ahead of Competitors Here’s something most founders skip: watching what successful competitors actually do, not just what they say. I track competitor job postings, their content themes, even their customer case studies. When three competitors start hiring growth marketers simultaneously, that’s market intelligence gold.

Questions I Ask Every SaaS Client

During strategy sessions, I dig into these specific areas with founders:

What’s happening to your market share while you optimize that ratio? I’ve seen companies lose 40% market position chasing perfect efficiency numbers.

Are you actually comparing apples to apples with competitor metrics? Most public LTV:CAC numbers exclude hidden costs like team salaries and tools.

When did you last test a “wasteful” marketing experiment? Sometimes the channels that look expensive on paper unlock entirely new customer segments.

How many potential customers never convert because you’re not investing enough in the full journey? Low CAC means nothing if you’re missing qualified prospects.

What I’ve Learned Working in SaaS Content

My work across different SaaS companies keeps teaching me the same lesson: founders who obsess over perfect metrics often build fragile businesses. The sustainable growers? They worry more about market timing than mathematical beauty.

I remember one client who spent months optimizing their Google Ads to achieve a 6:1 ratio. Meanwhile, their competitor launched a partner program and captured 60% of their target market. Beautiful metrics, terrible business outcome.

Real growth comes from understanding when numbers serve you versus when they limit you. Some quarters demand aggressive spending to grab market position. Others require tighter controls to preserve runway during tough periods.

The Reality Check Most Founders Need

SaaS markets move faster than your spreadsheet updates.

While you’re perfecting that LTV:CAC calculation, someone else is testing ten new acquisition channels and finding what actually works.

Through my content work, I see founders make the same mistake repeatedly:

They optimize for comfort instead of competitive advantage.

Perfect ratios feel safe. Messy, aggressive growth feels risky. But in most SaaS markets, the real risk is standing still.

LTV:CAC should help you make smarter bets, not avoid making bets entirely.

Think of it like a car’s speedometer — useful information, but not the reason you’re driving. You’re trying to reach a destination, not maintain perfect speed.

The best SaaS leaders I work with treat metrics as feedback loops, not finish lines. They adjust, experiment, and sometimes intentionally break their beautiful ratios to capture bigger opportunities.

In SaaS, your perfect ratio might be your biggest weakness.

Don’t let efficiency blind you to opportunity.

How are you balancing growth vs. efficiency right now? What’s one metric that misled you before you learned better?

I write SaaS content for product makers — reach me if you’d like to collaborate on growth-focused storytelling.