- SDRs: 60% base, 40% variable (meetings booked → opportunities)

- AEs: 50% base, 50% variable (new ARR × retention multiplier)

- CSMs: 70% base, 30% variable (renewals + expansion)

Here’s the uncomfortable truth: your sales comp plan might be the reason your customers keep churning. I’ve seen this play out dozens of times, and there’s a way to fix it.

Radha called me on a Thursday afternoon, and I could hear the frustration in her voice.

“I don’t get it,” she said. “We’ve got product-market fit. Our demo-to-trial conversion is solid. But our churn numbers are terrible, and my sales team seems to care more about closing than actually helping customers succeed.”

Radha’s story isn’t unique. Her startup was doing everything “right” on paper — good funding, decent team, strong early traction. But there was this nagging problem that kept getting worse each quarter.

Her best sales rep had just closed three deals in two weeks. Sounds great, right? Except two of those customers canceled within 60 days. The third was already asking for features that didn’t exist and threatening to leave.

The issue wasn’t her product or her market. It was something most founders never think to examine: her sales compensation plan was incentivizing all the wrong behaviors.

I see this mistake constantly. Founders copy compensation structures from traditional software companies or bigger enterprises, not realizing that SaaS is a completely different game. When your revenue comes from keeping customers happy over years, not just getting them to sign a contract, everything about how you pay your team needs to change.

The $2M Lesson I Learned the Hard Way

Let me tell you about my own screw-up. At my second company, we were crushing our new customer targets. Month after month, the team was hitting 110–120% of quota. I was feeling pretty good about our comp plan.

Then I looked at the six-month retention numbers.

We were losing almost half our customers before they hit their first renewal. Our Customer Acquisition Cost was through the roof because we kept having to replace churned revenue. That “successful” comp plan was actually costing us about $2M in lifetime value.

The problem was obvious once I saw it: We were paying reps the same commission for a customer who stayed two months as one who stayed two years. Our incentives were completely disconnected from business outcomes.

Traditional enterprise software works differently. You sell a perpetual license, collect a big upfront payment, and move on. Your commission is earned whether the customer uses the software or not.

SaaS flips this on its head. That $50K annual contract only becomes valuable if the customer renews. If they churn after three months, you’ve lost money on the deal when you factor in acquisition costs, onboarding, and support.

But most comp plans ignore this reality. They pay reps like we’re still selling perpetual licenses in 2010.

What Actually Drives Sustainable Growth

Look, I’m not going to give you some theoretical framework that sounds good in a boardroom but falls apart in practice. This is what actually works when you’re trying to build sustainable growth:

Start with what really matters to your business

Forget the fancy metrics for a minute. If you’re early stage, you probably need logos more than anything else. Your comp plan should reward new Monthly Recurring Revenue, but — and this is crucial — tie it to customer success from day one.

Here’s what I mean: Don’t pay full commission until a customer has been active for at least 90 days. I learned this the hard way at my second startup when we were paying reps for deals that churned before we even finished onboarding.

Some founders worry this will demotivate their sales team. In my experience, it does the opposite. It forces reps to really understand whether a prospect is a good fit before they push for a close. Quality goes up, churn goes down.

Match incentives to what people actually control

Your SDRs shouldn’t be paid the same way as your account executives. Your customer success team definitely shouldn’t have the same structure as your new business team.

I like keeping SDRs focused on meeting quality — they get paid when they book demos that actually show up and engage. Account executives get the bigger variable comp because they’re closing new ARR, but they also take the hit when customers churn early.

Customer success managers? They should be rewarded for renewals and expansion. Period. Not new business, not meetings booked. Just keeping customers happy and growing their accounts.

Comp Plan

Here’s a rough breakdown that’s worked well for me:

SDRs: 60% base, 40% variable (paid on qualified meetings that convert to opportunities) AEs: 50% base, 50% variable (paid on new ARR with 90-day retention requirement)

CSMs: 70% base, 30% variable (paid on renewal rate and expansion revenue)

Keep it simple enough that people can actually understand it

I once worked with a startup that had seventeen different modifiers in their comp plan. Seventeen! Their reps needed a spreadsheet just to figure out what they’d earn from a deal.

That’s insane.

If your sales team can’t explain their comp plan to their spouse over dinner, it’s too complicated. I stick to two, maybe three main components max. Base salary, commission on new ARR, and maybe an accelerator for hitting quota. That’s it.

The best comp plan I ever designed fit on a single page. Everyone knew exactly how much they’d make from any deal, and they could calculate it in their head while on a sales call.

Smart Incentives That Actually Work

Even simple plans benefit from well-designed incentives. Here’s what I’ve seen work in practice:

Accelerators that make reps want to overachieve

About 80% of successful SaaS companies I work with use accelerated commission rates for over-performance. The psychology is powerful.

I typically structure it like this:

- 8% commission up to 100% of quota

- 12% commission from 100–125% of quota

- 15% commission above 125% of quota

This means a rep earning $60K at exactly 100% quota jumps to $75K at 120% quota. That extra $15K for 20% more performance keeps top performers motivated and prevents them from coasting once they hit their number.

Clawbacks that prevent disasters

In SaaS, you often pay commission at booking but collect revenue over months or years. This creates a dangerous misalignment.

I use clawbacks to fix this: If a customer churns within 90 days, the rep pays back 50% of the commission. If they churn within 180 days, it’s 25%.

Sounds harsh? It’s not. It makes reps more selective about prospect quality and prevents the “sign anyone with a pulse” mentality that kills SaaS businesses.

One rep at my last company initially complained about our clawback policy. Six months later, he thanked me for it because his retention rates were so much better than his previous job. He was actually making more money with fewer deals because they stuck around.

SPIFFs for strategic focus

Sales Performance Incentive Funds (SPIFFs) are short-term bonuses that drive specific behaviors. I use them sparingly, but they’re powerful when deployed right.

Examples that work:

- $1,000 bonus for each annual prepay deal (helps cash flow)

- Extra 2% commission for multi-year contracts

- $500 bonus for deals in target verticals you’re trying to penetrate

The key is making them time-bound and aligned with real strategic priorities, not just random incentives that confuse your main comp plan.

The Traps That Kill Everything

I’ve watched good comp plans turn into disasters because founders made these classic mistakes:

The “let’s add just one more thing” mistake

You start with a clean, simple plan. Then marketing wants reps to focus on a new product line, so you add a SPIFF. Then customer success complains reps aren’t setting up customers for renewal success, so you add renewal bonuses. Then finance wants longer payment terms, so you add annual prepayment incentives.

Before you know it, your comp plan looks like tax code.

I get it — every addition seems logical in isolation. But complexity kills motivation faster than anything else. Your reps will optimize for whatever’s easiest to understand and achieve, which usually isn’t what you actually need.

At one company I advised, they had added so many modifiers that their top rep was actually earning less than their average performer because of how the different bonuses and penalties interacted. That rep quit within a month.

The “set it and forget it” trap

Your business changes. Your market shifts. Your priorities evolve. But somehow your comp plan stays exactly the same for two years.

I see founders who are laser-focused on optimizing their product, their marketing, their operations — but their comp plan hasn’t been touched since they hired their first sales rep.

That’s backwards. Your comp plan should evolve with your business, not lag behind it. I review comp plans quarterly and make adjustments annually. Not major overhauls, but tweaks that keep incentives aligned with current priorities.

Example: If you started focused on new logo acquisition but now need to prioritize expansion revenue, your comp plan should shift to reward account growth, not just new deals.

The “hope and pray” quota problem

This one makes me crazy. Founders who set quotas based on what they need to hit their board projections, not what’s actually achievable based on pipeline, conversion rates, or historical performance.

Setting impossible quotas doesn’t motivate anyone — it just creates a culture where everyone knows the targets are fake. Your best reps will leave, and your remaining team will stop caring about performance altogether.

Base quotas on real data. Look at your sales cycle length, your average deal size, your win rates. Build quotas that stretch people but don’t break them.

I aim for 60–70% of reps hitting quota in any given quarter. If it’s higher than that, quotas are too easy. Lower than that, and they’re unrealistic.

How Plans Should Evolve as You Grow

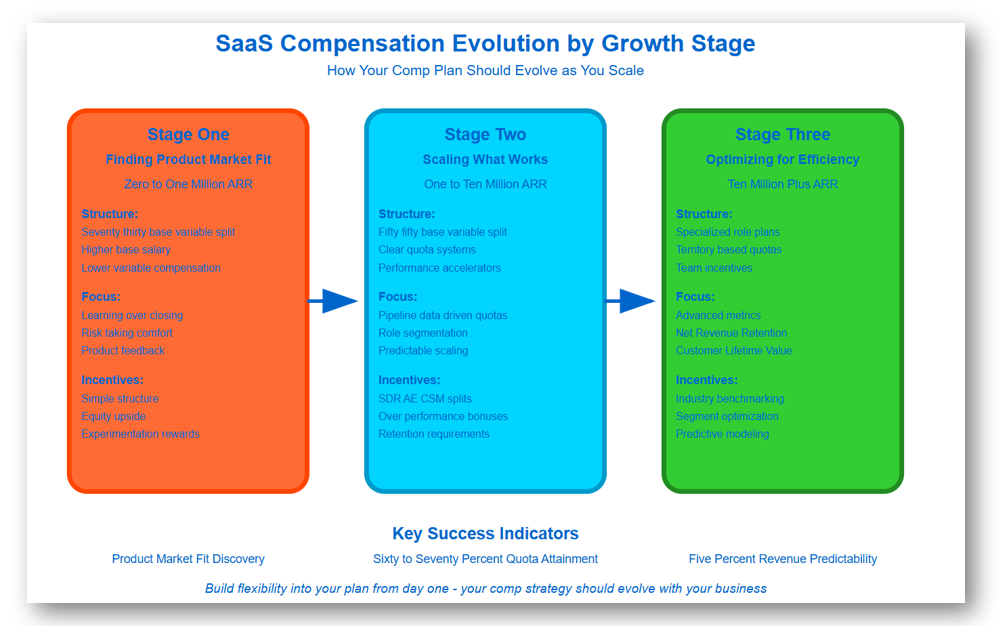

Your compensation strategy isn’t static. Here’s how I’ve seen it evolve across different stages:

Stage 1: Finding Product-Market Fit ($0–1M ARR)

- Higher base salary, lower variable (maybe 70/30 split)

- Focus on learning, not just closing

- Simple structure with equity upside

- Reps should be comfortable taking risks and giving product feedback

Stage 2: Scaling What Works ($1–10M ARR)

- Move to 50/50 base/variable split

- Clear quotas based on actual pipeline data

- Introduce accelerators for over-performance

- Start segmenting by role (SDR, AE, CSM)

Stage 3: Optimizing for Efficiency ($10M+ ARR)

- Specialized comp plans for different roles and segments

- Sophisticated metrics like Net Revenue Retention and Customer Lifetime Value

- Regular benchmarking against industry standards

- Territory-based quotas and team incentives

The key is building flexibility into your plan from day one. Use tools that make it easy to model changes and track performance over time.

The Real Results

When Radha redesigned her compensation plan around these principles, the changes were dramatic:

- Customer churn dropped from 8% to 3% monthly within six months

- Sales productivity increased 35% (measured by revenue per rep)

- Rep satisfaction scores went from 6.2 to 8.7 out of 10

- Revenue predictability improved significantly — she could forecast quarterly numbers within 5%

More importantly, her sales team transformed from order-takers to growth drivers. They started having deeper discovery conversations, qualifying prospects more rigorously, and actually caring about customer success because their paychecks depended on it.

The lesson here isn’t complicated: Well-designed compensation plans don’t just motivate sales teams — they become strategic weapons for sustainable growth.

Your comp plan is either accelerating your growth or secretly sabotaging it. There’s no middle ground.

Take a hard look at yours. If your reps optimized perfectly for their current incentives, would that drive the business outcomes you actually need?

If the answer isn’t a clear yes, it’s time for a redesign.

I’ve helped dozens of SaaS founders redesign their comp plans over the past decade. The companies that get this right grow faster, retain customers longer, and build more predictable revenue engines. The ones that don’t… well, they usually don’t make it past Series A.

Want to share your own comp plan disasters or wins? I’d love to hear about them in the comments.

What You Can Do Right Now:

- Audit your current plan: Does it reward customer success or just deal closing?

- Check your 90-day retention rates by rep — that’ll tell you everything

- Simplify: If your team needs a calculator to understand their comp, it’s too complex

- Set realistic quotas based on actual performance data, not wishful thinking

- Review quarterly, adjust annually — your comp plan should evolve with your business.

I share real SaaS growth lessons like this every week — follow along if that’s your thing.