Discover 2025 LTV CAC ratio benchmarks for SaaS companies. Get real-world insights on why 3:1 isn’t always optimal and learn industry-specific customer acquisition strategies.

Press enter or click to view image in full size

So I was in this board meeting last month, right? Our numbers looked great on paper — 7:1 LTV CAC ratio, solid margins, everyone feeling pretty good about themselves.

Then our investor drops this bomb: “Your biggest competitor just raised $50M and they’re growing 4x faster than you with a 3:1 customer acquisition cost ratio.”

That’s when it hit me. We’d been so focused on having the “perfect” SaaS metrics that we completely missed the bigger picture.

Here’s what nobody tells you about LTV CAC ratios in 2025

Everyone and their dog talks about this SaaS metric, but most people are calculating customer acquisition costs wrong. They throw around numbers like “3:1 is good” without understanding what the hell they actually mean for SaaS growth.

Let me break down these SaaS benchmarks properly.

Customer lifetime value (LTV) is how much money a customer will pay you over their entire lifetime. Not just their first month or year — everything. If someone pays you $50/month for 24 months, that’s $1,200 LTV.

Customer acquisition cost (CAC) is what it costs to get that customer in the door. Your ads, your sales team, that trade show booth that cost way too much, your marketing tools — everything.

The LTV CAC ratio? It’s just dividing one by the other. But here’s where it gets interesting for SaaS companies.

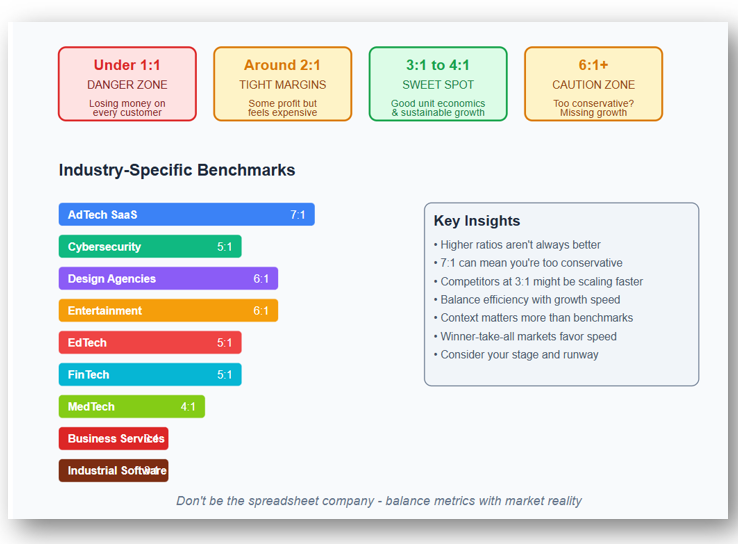

SaaS LTV CAC benchmarks that actually matter in 2025

Under 1:1 — You’re screwed. You’re paying more to get customers than they’ll ever pay you back. I’ve been here with my first SaaS. It sucks.

Around 2:1 — You’re making some profit, but it feels tight. Every new customer acquisition feels expensive because they kind of are.

3:1 to 4:1 — This is where most successful SaaS companies live according to industry benchmarks. Good unit economics, sustainable growth, investors are happy.

6:1 and up — Here’s the tricky part with SaaS metrics. High ratios can actually be a red flag. You might be sitting on cash while competitors eat your lunch.

I learned this one the hard way. We hit 7:1 and thought we were killing it. Meanwhile, our main competitor was burning money at 3.5:1 but scaling like crazy. Guess who ended up with more market share?

Customer acquisition strategies and their true costs

Not all marketing channels are the same for SaaS customer acquisition. Some are cheap, some are expensive, some take forever to work.

Email marketing has incredibly low customer acquisition costs if you’ve got a good list. But building that list? That takes time and impacts your SaaS unit economics.

Paid ads can work fast but they’re expensive for customer acquisition cost. Most SaaS companies I know get 2:1 to 4:1 LTV CAC ratios from Facebook or Google ads.

SEO is the holy grail for SaaS growth — cheap customers once it kicks in. But you’re looking at 12–18 months before you see real results in your customer lifetime value calculations.

Sales teams? They can get you 8:1 LTV CAC ratios if you’re selling enterprise deals, but your sales cycle might be 9 months long.

2025 SaaS industry benchmarks: Real LTV CAC data

I’ve talked to a bunch of SaaS founders across different spaces. Here’s what they’re actually seeing in their customer acquisition cost benchmarks:

AdTech SaaS companies usually hit around 7:1 LTV CAC ratios. Their customers stick around forever because switching ad platforms is a pain. But a lot of them get too comfortable with their customer lifetime value.

Business services hover around 3:1 for customer acquisition cost. It’s competitive as hell and expensive to acquire customers in B2B SaaS.

Cybersecurity SaaS firms do well — usually 5:1 LTV CAC ratios. People don’t mess around when it comes to security, so churn is low and customer lifetime value is high.

Design agencies often see 6:1 ratios. When clients love your work, they stick around and refer friends, improving your SaaS metrics.

EdTech varies wildly but averages around 5:1 for customer acquisition cost. B2B is usually better than B2C for SaaS unit economics.

Entertainment platforms can hit 6:1 LTV CAC ratios, especially with subscriptions. People get attached to their shows.

FinTech typically sees 5:1 customer acquisition cost ratios. Financial switching costs are real for SaaS companies.

Industrial software struggles more — usually 3:1 LTV CAC ratios. Long sales cycles and tough competition affect customer lifetime value.

MedTech and pharma both hover around 4:1 for their SaaS metrics. Compliance creates stickiness but also slows everything down.

The big mistake everyone makes

Here’s what drives me nuts: founders chase some magic number they read in a blog post instead of thinking about what makes sense for their business.

If you’re burning through your seed round trying to figure out product-market fit, 2:1 might be perfectly fine. You’re buying data and learning.

If you’re Series B with clear PMF and that same 2:1 ratio? That’s a problem.

If you’re profitable and hitting 7:1 while your competitors are scaling fast? You might be missing the boat.

What you should actually do

Stop obsessing over hitting some benchmark you read somewhere. Ask better questions:

Where are you in your journey? Early stage companies can afford to spend more to learn faster.

How fast do you need to grow? Sometimes lower ratios at higher growth create more value than perfect ratios with slow growth.

What’s your competition doing? In winner-take-all markets, speed might matter more than efficiency.

How much money do you have? Your runway should influence how aggressive you can be.

The real lesson

Your LTV CAC ratio isn’t some score you’re trying to optimize. It’s information about your SaaS business that should help you make better decisions about customer acquisition cost and growth strategy.

The SaaS companies that figure this out — the ones that balance good unit economics with aggressive growth — those are the ones that win in 2025.

The rest sit around optimizing SaaS metrics spreadsheets while their competitors scale past them.

Don’t be the spreadsheet company.

What’s your current LTV CAC ratio telling you about your SaaS business? Have you made any of these customer acquisition mistakes? I’d love to hear your stories in the comments.